A great watch does more than tell time — it tells a story. For collectors and investors alike, a luxury watch investment can offer lasting value, with some even appreciating significantly over the years. But not every watch becomes a smart investment.

Understanding watches that appreciate in value means knowing the history, the market, and what collectors are looking for. In this guide, we’ll break down the key factors that drive value and highlight the brands and models worth watching.

Wondering about your Rolex resale value or the best watches to auction? Contact Joshua Kodner for expert guidance and valuation services.

What Makes a Watch Increase Value Over Time?

Not every luxury watch becomes more valuable with time but some do, and dramatically so. Whether you’re buying for investment or passion, knowing what drives long-term value is key.

Several key factors influence a watch’s ability to hold or increase in value and these factors can shift with time, market trends, and collector demand. With a rising market for rare watches, it’s worth understanding what makes certain models stand out in the world of high-end horology before you make a luxury watch investment.

Brand prestige

When it comes to long-term value, the brand behind the watch matters — big time. Brand prestige is one of the biggest selling points and are some of the best watches to auction.

Iconic names like Rolex, Patek Philippe, and Audemars Piguet have built reputations over generations for precision, craftsmanship, and exclusivity. These brands consistently produce watches that hold (or even grow) their value over time. For example, Rolex resale value will always be high because of the quality of craftmanship, rarity, and luxury value. Read on for more details on each brand!

Rarity and limited editions

Limited editions, discontinued models, and rare configurations tend to become collector favorites. Timepieces made in small quantities or featuring unique dials, movements, or materials often command higher prices at resale.

Think Rolex’s “Paul Newman” Daytona or the Patek Philippe Nautilus. These iconic watches have turned into rare pieces that now fetch impressive premiums.

Condition and history

A watch’s condition is one of the most critical factors in determining its value. Original parts, minimal wear, a complete set (box and papers), and proper servicing all boost desirability.

Additionally, provenance, which is a paper trail for the watch’s ownership history, can add a premium, especially if you have documentation that the watch once belonged to a notable figure or has an interesting story.

Market trends and buyer demand

Just like art or real estate, watch values are influenced by market demand. Cultural trends, celebrity endorsements, and even economic shifts can make certain styles skyrocket in value. Staying on top of watch industry news and collector interest can help you make smart, well-timed investment decisions.

Which Watch Brands Hold Their Value Best?

When it comes to watch collecting and investing, not all brands are created equal. While personal taste and market timing play a role, a handful of luxury watchmakers consistently stand out for producing timepieces that retain and grow their value over time.

Let’s take a closer look at the brands and models that have proven to be strong performers for watches that appreciate in value over time.

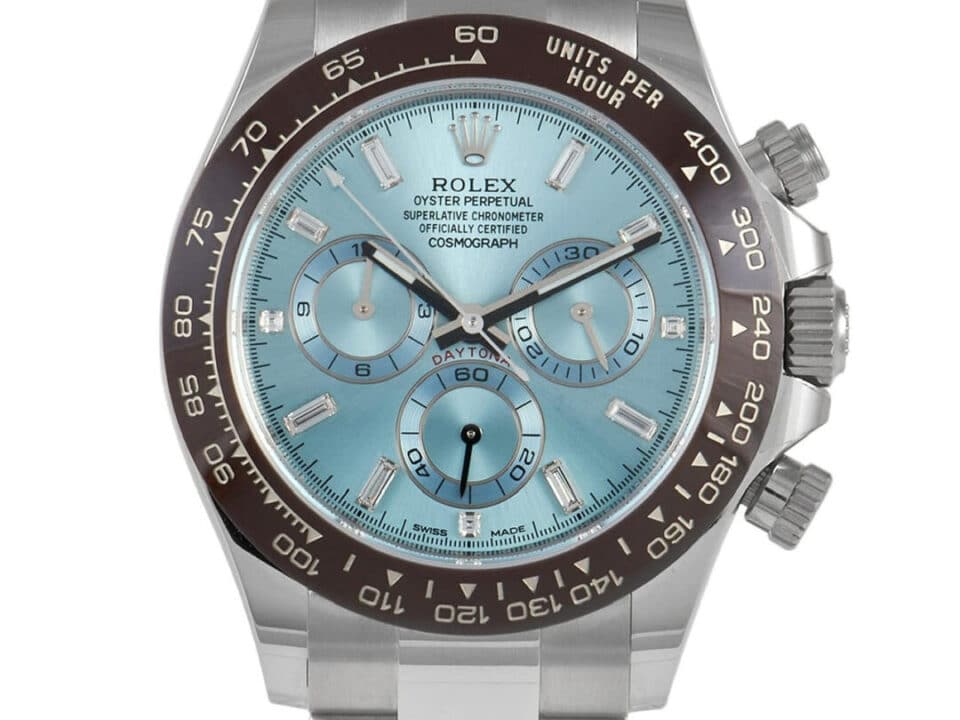

Rolex: The gold standard of value retention

Arguably the most recognizable luxury watch brand in the world, Rolex has long been a go-to for collectors and investors alike. Known for their durability, precision, and iconic design, models like the Submariner, Daytona, and GMT-Master II remain in high demand and Rolex resale value rarely, if ever, drops in value.

- The Submariner, with its timeless design and rugged build, continues to be a solid investment, especially vintage models with rare dial variations.

- The Daytona, particularly the “Paul Newman” variant, has seen explosive growth at auction over the past decade.

Patek Philippe: Luxury, legacy, and limited production

Patek Philippe is synonymous with heritage and exclusivity. As one of the “Holy Trinity” of watchmaking (three of the most prestigious Swiss watchmakers: Patek Philippe, Audemars Piguet, and Vacheron Constantin), Patek’s commitment to craftsmanship and innovation places it among the top investment-worthy brands.

- The Nautilus, designed by Gérald Genta, is perhaps the brand’s most iconic sports watch with its low production numbers and growing demand have pushed resale values sky-high.

- The Aquanaut also continues to rise in popularity, especially among younger collectors.

Audemars Piguet: Iconic innovation with the Royal Oak

Another member of the watchmaking “Holy Trinity,” Audemars Piguet has carved out a lasting legacy — largely thanks to the Royal Oak.

- Launched in 1972, the Royal Oak’s bold, octagonal bezel and integrated bracelet were revolutionary.

- Limited editions and early vintage models are especially valuable and continue to increase in demand.

Vacheron Constantin: Rare, understated prestige

As the oldest continuously operating watch manufacturer in the world, Vacheron Constantin brings centuries of horological excellence to every timepiece. While not always as loudly hyped as Rolex or Patek Philippe, their watches are revered among serious collectors and quietly hold, or even increase, in value over time.

- Models like the Overseas, especially the Overseas Dual Time and Chronograph, have become increasingly desirable thanks to their sporty-luxury appeal and versatile wearability.

- Limited editions and vintage pieces, such as the Historiques Cornes de Vache 1955, have performed well at auction, often commanding prices well above original retail.

Cartier: Classic design meets current demand

Known for elegance and timeless design, Cartier watches (especially models like the Tank, Santos, and Panthère) are experiencing a resurgence in both fashion and collectability.

- The Cartier Tank and Santos models are especially hot right now, with trends like square watch faces fueling renewed demand.

- The Panthère, particularly in its diamond-studded women’s versions, continues to be a strong performer at resale.

Maximize the Value of Your Luxury Watch with Joshua Kodner

Whether you’re ready to part with a rare Rolex, a vintage Speedmaster, or a limited-edition Vacheron Constantin, selling your watch is all about timing, presentation, and expert guidance. Contact our team at Joshua Kodner today for a free appraisal or to learn more about how we can help you navigate the selling process from start to finish!